Fintech marketing is a major part of how financial technology solutions find their way into the hands of businesses and consumers who need them most. By combining data-led techniques and creative resources, fintech businesses can increase user interaction while fostering credibility.

By building methods based on understanding consumer behavior, leveraging analytics, and creating tailored campaigns, businesses can better position themselves to compete in a fast-changing market. Fintech marketing is uniquely positioned to market services for both profitability and accessibility—all while maintaining inclusivity and relatability.

Most importantly, it delivers on the varied needs, expectations, and preferences of today’s digital-first audiences.

What is Fintech Marketing

Fintech, or financial technology, is simply the incorporation of technology into offerings by financial services companies to improve their use by consumers. It includes everything from weathergage banking apps to online lending platforms.

Fintech marketing is the practice of effectively communicating these innovative, technology-based financial solutions to the proper demographic. This means more than just marketing these new innovations; it means clearly conveying the distinct value these new products provide.

Take, for instance, a new fintech app that makes bill payments convenient with a few taps on their smartphones. It allows them to apply for loans, putting greater financial management within reach with ease and convenience.

The role of marketing in fintech is not just to highlight cool features. It’s all about empathy — putting yourself in the shoes of your future users. A young professional tends to value convenient and seamless investment tools. Comparatively, a small business owner tends to prefer simpler loan applications.

A solid fintech marketing strategy recognizes the needs of the target market and positions the brand’s message to match those needs. Your long-term goal should be to create enough trust to increase engagement. This will help you convert interest into action, such as downloading an app, signing up for a service, or executing a financial transaction.

Scope and Applications in the Industry

Fintech marketing is an all-encompassing industry impacting every sector – personal finance, investments, corporate banking, and more. Marketing peer-to-peer payment apps like Venmo use social media to create highly sharable, fun, and relatable content.

This tactic cuts through the noise among younger audiences. Most B2B fintech platforms love to call attention to comprehensive case studies. These provide examples of how their tools increase efficiency for companies. The scope is huge, and the approaches are equally diverse.

Fintech marketing changes as consumer behaviors change. Today’s consumers want hyper-personalized experiences, and fintechs deliver on this expectation with next-best-action ads, emails, and in-app messages. Products such as digital wallets, investment platforms, and budgeting tools thrive due to this highly-targeted approach.

Tech integration goes hand in hand with the first point and is another core quality of fintech marketing. For instance, AI tools can be used to analyze customer data to predict future trends and create targeted campaigns with laser precision.

Gamification techniques turn learning into an enjoyable and engaging experience. By incentivizing users to learn with financial education modules, we keep audiences more engaged.

Target Market for Fintech Businesses

Reaching their ideal audience isn’t simple. Fintech companies target a wide range of customers. That sameness extends to their audiences as well, from tech-savvy millennials to Gen Z users and even older generations getting used to digital financial solutions.

Every one of these groups has different needs, wants, and pain points. Millennials and Gen Z expect a mobile-first experience. They are more likely to use fintech apps if they offer attractive rewards, like cashback or referral bonuses.

Fintech businesseses should recognize these pain points to develop successful marketting strategy. Young adults who use budgeting apps usually like easy-to-read, clear dashboards. Traditional investors are looking for easy-to-understand tools, while crypto enthusiasts prefer platforms with sophisticated analytics.

By segmenting the audience, fintech businesses can deliver more personalized experiences which lead them to higher levels of user satisfaction and retention.

Challenges Unique to Fintech Marketing

The fintech market’s saturation is a huge challenge. In a crowded space where every app or service can easily be replaced, getting noticed takes creativity but extreme precision.

Take, for example, companies that focus heavily on viral marketing campaigns to get noticed, which can work but isn’t a long-term solution. Once you get a user, keeping them around is arguably a tougher task, as switching from app to app is usually only a handful of clicks away.

A second challenge is the cost of campaigning. Fintech startups especially will run into issues with smaller budgets. This reality makes it critical to do more with less and prioritize ROI by pouring dollars into more cost-efficient channels such as social media and influencer partnerships.

In reality, this over-reliance on AI-generated content will come back to haunt you if it’s not equipped with that human touch that establishes trust with users.

Importance of Fintech Marketing

Discover New Audiences

This is where fintech marketing comes in and can make a huge impact in finding and targeting these untapped audiences. In an age where almost anyone can be a customer of a fintech, the opportunity to grow your audience is huge.

Fintech companies take advantage of data from CRM systems, social media platforms, and user behavior data. This enables them to know which targeted groups’ needs are aligned with what they provide. Younger users are typically big fans of budgeting apps.

In the meantime, small business owners should reap the benefits of more sophisticated payment solutions. Customizing marketing strategies to these distinct groups gets fintech solutions into the hands of those who need them most. This method helps make sure that the products directly speak to their target audience’s unique financial needs.

Building Trust and Loyalty

While trust is the foundation of the financial services industry, great fintech marketing is key to building it. Transparent communication reassures customers about the safety and reliability of services.

Trust-building extends beyond initial interactions:

- consistent messaging,

- proactive communication about security measures,

- addressing concerns, such as phishing risks.

This helps nurture long-term customer relationships.

Once you build trust, you build loyalty and engage users who become ambassadors for your brand.

Personalization and Audience Data

The fintech industry is all about customization and personalization, and marketing initiatives should follow suit. By leveraging audience data, businesses can create campaigns that seem completely customized to someone’s specific requirements.

Take, for instance, Amazon — the company that has proven just how impactful personalization can be, with 35% of its purchases powered by recommendations. Smart fintech companies can take this principle and run with it, using users’ financial data to recommend products that make the most sense for them.

A budgeting app can suggest savings plans tailored to your spending patterns. At the same time, an investment platform would recommend portfolios based on your risk level. Tailored communications make customers feel appreciated, and their fintech experience becomes more effective and valuable.

Financial Literacy

Fintech marketing isn’t just about making the sale. It’s a chance to educate. Make complicated financial topics easier to understand and empower customers to make informed decisions so you can foster a more educated customer base.

Businesses that focus on educating their audience tend to have the best engagement because customers appreciate content that provides tangible real-world value. Fintech companies have the opportunity to use education to demystify confusing subjects such as credit scores and retirement planning.

Ideally, they would do this through educational content like blog posts, videos, and interactive tools. This commitment to education builds trust with customers and can even further position fintech businesses as smart partners in their financial journeys.

Advantages of a Defined Strategy

A clearly defined fintech marketing plan can provide several benefits, beginning with bringing you clarity. It allows businesses to create definitive benchmarks, budget accordingly, and tackle the most important things first.

Fintech companies are spending millions each year on marketing and a systematic approach helps make sure that precious resources aren’t thrown away. Rather than casting a wide net, tailor your fintech marketing strategy to reach those specific millennials who are more open to using digital wallets.

Or think of retirees who are saving for health care expenses. This laser-focused precision results in more successful outcomes at a lower cost.

Brand Awareness and Visibility

Effective fintech marketing can help fintechs make a big splash in the market. An integrated strategy ensures that you provide unified messaging no matter the b2b marketing channel.

This applies to everything from social media to email campaigns, ensuring a consistent brand image. The resulting increased visibility helps potential customers better recognize and trust the brand.

When a fintech app delivers seamless payment solutions to consumers, then promotes its solution via ads focusing on user-friendly interface. This holistic approach appeals to more tech-savvy individuals, as well as those new to financial technology.

Customer Engagement and Conversion Rates

Customer acquisition and engagement are more important than ever, and a strong fintech marketing strategy can be the key to success. Interactive campaigns, personalized email updates, or timely push notifications are just a few ways fintech companies can use creative campaigns to educate and retain users.

This engagement invariably leads to increased conversions. Providing a limited-time, free trial of a premium feature ignites user curiosity. This prompts them to learn more, eventually turning them into paying customers.

When customers experience a genuine sense of being valued and understood, they are more likely to commit.

Critical Role of Trust

Trust is a cornerstone of all marketing, but especially in fintech, where financial data is highly sensitive. Without this confidence, even the best solutions have a hard time taking off.

Customers desire assurance that a company is thinking about them first. Acting proactively regarding security concerns, including phishing and information breaches, is a sign that a brand is responsible and caring about its customers.

Such a move creates trust at first glance.

Build and Retain Customer Confidence

As you can see, transparency is one of the best ways to build trust. Loyalty programs and referral incentives are great ways to value current customers and keep them coming back.

They further incentivize these customers to become brand advocates, building a virtuous cycle of trust and expansion.

Prioritize Education

In the world of fintech, education reigns supreme over hard-selling tactics. Consumers value providers who take the time to educate them on available solutions as opposed to jumping immediately into a sales pitch.

A straightforward guide on how to pay your credit card bill can really resonate. It resonates with their needs so much more than simply marketing low interest rates.

Simplify Complex Concepts

We know financial terms can be intimidating, but good marketing makes them accessible. Taking the time to use relatable examples or analogies can help make complex subjects more digestible.

You could teach compound interest with a story about how to grow a healthy garden. This strategy assists users in grasping the idea quickly and without intimidation.

Create Resources

Educational resources such as blogs, FAQs, and how-to videos are worth their weight in gold. Added bonus, though — they don’t just deliver real value right away, they showcase the company behind them as a thought leader in the space.

Users are likely to seek out these assets when they have a specific question, further establishing the brand’s position as a trusted advisor.

Effective Strategies for Fintech Marketing

Fintech companies need to know digital marketing tactics that can help them build a strong presence in a competitive marketplace. Top digital channels are:

- social media,

- search engine marketing,

- display retargeting.

These channels give fintech brands the opportunity to reach diverse, multi-generational demographics. Platforms such as LinkedIn are great for targeting professionals, as you can imagine. At the same time, Instagram and YouTube reach younger audiences who are hungry for simplified financial solutions.

Targeted advertising allows fintech companies to connect with potential customers more effectively. They do this most effectively through targeted Google Ads and social media campaigns. By being able to target their ads to specific demographics, interests, and search keywords, these companies can maximize their conversion rates.

A well-targeted Google Ads campaign with an enticing call-to-action will make anyone stop and look. Eye-catching graphics will reel in users who are already on the lookout for fintech solutions. Fintech content marketing serves a big purpose with regard to establishing brand authority.

In addition to building brand credibility, producing informative content like blogs, case studies, and tutorials educates customers on complex financial concepts. Analytics tools like Google Analytics and HubSpot help fintech companies track how well their campaigns are performing. With these insights, they can fine-tune their strategies, doubling down on what’s driving the most engagement and improving what’s not.

1. Leverage SEO for Organic Growth

SEO is the foundation of attracting organic traffic to your fintech’s website. Improving website architecture and increasing mobile usability leads to higher rankings in search engines. At the same time, increasing your page load speed means users have a frictionless experience.

Keyword research is an essential first step to identifying the most relevant search terms to target. A fintech company that offers student loans, for instance, might focus on keywords like “best student loan options.” They can further focus on “low-interest college loans” to get more leads.

Including these relevant keywords intentionally in website copy, meta-descriptions, and header tags helps bring in more users who are actively searching for these services. Continual SEO work, like refreshing blog posts with new information and building backlinks, is essential in having the site found on the search results page.

Regular audits are useful in finding and resolving issues, keeping your site ahead of the curve.

2. Personalize Communication with Email Marketing

Email marketing is still one of the best ways to interact with consumers–especially when it’s targeted. Highly personalized campaigns that speak directly to customers, using their names and providing product suggestions that fit their needs, boost open rates.

For instance, automated emails can notify users who abandon applications halfway through the process to return to their application. Implementing email list segmentation based on user behavior or expressed preferences keeps messaging relevant and timely.

For example, a fintech firm might deliver investment advice to one segment of customers while providing credit-building strategies to another. Automated platforms, such as Mailchimp, make this process easy, allowing for regular, automated communication without extra work.

Relevant, personalized content increases click-through rates and conversions.

3. Automate Marketing Processes Effectively

Automation can take care of repetitive tasks, allowing resources to be shifted toward more long-term strategic planning. Tools like Hubspot and Salesforce help align your sales and marketing teams so they’re always in sync and data is automatically shared without manual transfers.

This single, unified approach makes things more efficient and error-proof. Automated email campaigns are among the most powerful tools for nurturing leads. For example, financial services marketers can use drip campaigns to nurture prospects with educational resources on services over days, weeks, or months.

Use third-party tools to enrich data and gain deeper insights into customer needs, then refine your outreach strategies. Automation lowers costs, enabling fintech businesses to focus budgets on high-impact areas.

4. Build Empathy with Your Audience

When you understand your customers’ emotions and needs, you create more meaningful connections. Relatable marketing messages that speak to specific pain points, such as making loan applications easier or lowering fees, are received much better.

Strong storytelling – like showing the success of actual users – can help humanize the brand and establish trust. Active listening, whether through customer surveys or feedback forms, guarantees that customer voices inform and influence marketing strategies.

By humanizing their marketing with this empathetic approach, fintechs can deepen relationships with prospects and customers, increasing lifelong loyalty.

5. Tap into New and Emerging Markets

Opportunities in emerging markets are ripe for the taking. By tailoring strategies to cultural nuances, companies can resonate with local audiences in a more meaningful way. Providing concrete solutions to local needs such as multilingual platforms or solutions to region-specific financial challenges helps foster adoption.

Underserved demographics, like the unbanked, are big areas of growth potential. Analyzing industry trends, such as the adoption of mobile banking, is key to determining where to innovate. Customized, targeted solutions for these markets can find a strong, new beachhead in foreign markets.

6. Implement In-App Marketing Approaches

In-app marketing directly engages users within popular fintech applications to create a more immersive user experience. Elements such as interactive tutorials or gamification rewards for using the app help boost user satisfaction.

Push notifications—reminders for upcoming payments, offers tailored to users’ spending habits—draw users in without bombarding them. Analyzing user behavior within the app gives you actionable insights to help you continually optimize your marketing efforts.

For example, knowing which features users engage with most can help inform where a promotion or upsell should be placed, maximizing impact.

Best Practices for Fintech Marketing

Fintech marketing strategies are crucial for building brand presence, attracting customers, and fostering growth. Businesses need to engage multi-generational and tech-savvy audiences. Marketing strategies, including targeted advertising on platforms like Google Ads and social media and optimizing websites through SEO, help them reach their goals.

As fintech continues to evolve, tapping into emerging markets, improving in-app experiences, and analyzing continuous customer behavior are key to staying ahead of the curve and driving long-term success.

Establish Trust Through Transparency

One of the core principles at the base of all fintech marketing is trust. Being transparent about what your products are, what services you offer, and what your fees are is extremely important. People want to feel confident they understand precisely what they’re paying for with no surprises buried in the details.

For instance, showing a clear explanation of transaction fees versus interest rates builds trust. Nothing makes a more substantial connection with your audience than honesty, integrity, and transparency in your marketing messages. Things like misleading claims, misrepresenting your product, or vague promises erode trust in the long run.

Customer testimonials are another great way to build credibility. Show testimonials and case studies. Real-life success stories from satisfied users speak volumes and resonate much more with potential customers than generic ad campaigns. For example, showcasing user testimonials on your website or social media channels not only provides social proof but fosters authenticity.

Of course, fintech companies should be transparent about their data privacy and security practices. With digital safety worries increasing, users want to be reassured that their data is safe. Showcasing robust encryption standards, security, and adherence to regulations boosts trust.

Identify and Highlight Your Unique Selling Points

In a crowded landscape, finding ways to differentiate your fintech offerings is crucial. Highlighting what makes your services unique or one step above the competition will help distinguish you. Whether that’s quicker loan approvals, reduced service fees, or novel payment methods, fintech companies need to double down on what makes them special.

Real-world applications of your solutions through case studies can go a long way in showcasing your value. For instance, a case study on how your platform helped a small business streamline financial operations can connect with similar prospects. Aligning USPs with customer needs and delivering a product that USPs your competitors won’t make sense to customers will keep you ahead of the competition.

Engage Existing Customers Proactively

It’s just as important to engage your current customers as it is your prospects. Providing regular updates through newsletters or in-app notifications helps your audience stay engaged with what’s new and innovative. Maintaining this continual conversation fosters an atmosphere of trust and camaraderie.

Soliciting feedback through surveys or responsive customer reviews goes a long way to acknowledging that the journey can be improved. Customers enjoy a sense of empowerment when their feedback is taken into account.

Loyalty programs may be a classic strategy, but they’re still a powerful way to keep customers engaged. Offering perks like cashback, discounts, or exclusive access to premium features makes users more likely to stick around. Personal touches matter, too—tailoring experiences to individual preferences can turn one-time users into long-term fans.

Retention is driven by more than just acquisition. Personalizing services according to user behavior—like suggesting certain investment products—helps customers feel valued and recognized.

Communicate Support for Social Causes

While corporate social responsibility has never been more important, it is critical to the fintech space. When you support these social causes, they know you’re making an impact in their community, which helps build a positive brand image. Aligning your marketing initiatives with your company’s initiatives will show your company’s true colors.

Even more so, sponsoring local nonprofits to offer free financial education workshops increases your standing in the community. Transparency is essential in communicating social initiatives. Being transparent starts with having clear goals and a baseline for where you’re starting.

Backing community-minded initiatives, such as providing the cash to help local startups raise funds through crowdfunding, demonstrates you’re serious about being a force for good.

Offer Incentives to Build Loyalty

Incentives are the best way to gain and maintain customer loyalty. Referral bonuses, for instance, can incentivize current customers to recruit new ones. Giving discounts or free trials to long-time clients will make them feel appreciated.

Gamification can further boost engagement. Implementing a points-based system, in which users accrue points or rewards for achieving financial milestones, can make the entire experience more engaging and fun.

Acknowledging loyal customers in more visible ways, such as including them in case studies or providing exclusive benefits, makes that connection even more personal. This show of recognition creates a sense of personal connection and maintains their ongoing interest in your offerings.

How to Choose the Right Fintech Marketing Agency

Key Factors to Consider When Choosing an Agency

Experience in the fintech sector should be high on your list of priorities. Just as important is the understanding of your business goals. Your agency partner should be able to tailor their strategies to your goals, whether you need to focus on customer acquisition, retention, or ROI improvements.

Clear communication and strong collaboration are just as important. The right agency should be transparent and open to discussion, creating a partnership where ideas can flow and campaigns stay flexible and relevant.

B2B marketing budget matters, too. While staying cost-effective is essential, it’s just as important to focus on the value an agency brings to the table.

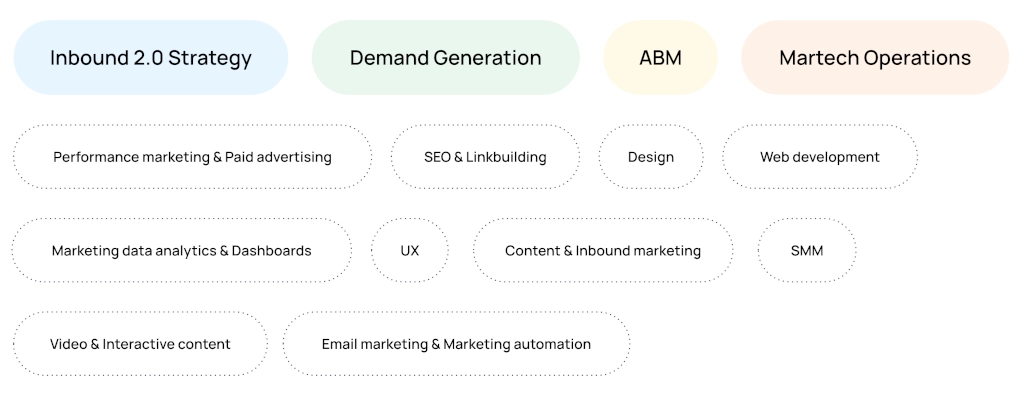

Services Offered by Fintech Marketing Companies

What services do fintech marketing agency provide? The expertise includes, but is not limited to:

- SEO (search engine optimization),

- content marketing,

- SMM (social media marketing),

- PPC (pay-per-click services, paid ads),

- Performance marketing for fintech,

- Fintech PR.

Integrated marketing solutions that can turn insight into action are essential. Merge multiple strategies into a single, focused plan to be consistent and maximize reach maximizes reach.

Data analytics is yet another cornerstone. Fintech marketing agencies with a strong analytics focus continuously improve campaign performance by optimizing and translating complicated metrics into valuable, actionable insights.

This data-driven approach is key to addressing fintech’s biggest challenges like high churn rates and improving customer retention. Value-added services like customization and precision targeting are becoming table stakes.

By using personalized marketing, fintech brands can better reach users who are genuinely interested in their services, leading to improved user engagement and loyalty.

How Agencies Help Overcome Marketing Challenges

Fintech marketing agencies help to overcome regulatory hurdles by making sure all campaigns are compliant with industry regulations. Their industry knowledge makes it easy for you to maneuver through these complexities so you can get back to focusing on growth.

Agencies can bring new, outside, objective perspectives. This can result in creative solutions, which is especially valuable in a field as fast-paced as fintech. Additionally, their expertise in improving campaign performance over time leads to more successful outcomes.

They have a team of specialists that live and breathe performance, optimizing in real-time to achieve your objectives. Collaboration Improvement is the third benefit.

Through a productive partnership with agencies, fintech companies will be able to address unique challenges head-on and craft a specialized and impactful marketing strategy.

Fintech Marketing Trends in 2026

Personalization is Must-Have

Personalizing content, products, and experiences so fintech brands can deliver what an individual customer wants or needs in the moment is proven to drive customer happiness. Customizing advice to align with their spending habits makes the interaction more refreshing and rewarding for customers. When you provide tailored, relevant investment recommendations that support their aspirations, your customers feel heard and appreciated.

Fintech companies can get personalized marketing by following these best practices. The most effective strategy starts with breaking your audience into smaller, highly targeted groups based on their behavior, preferences, and demographics. This allows for more personalized marketing—like email campaigns with customized offers or app features that adjust based on how users interact.

Data analytics allows businesses to analyze information about customers and forecast their behavior. This improves the customer experience and creates loyalty. 81% of consumers are more likely to trust a brand that understands them, which is crucial for driving long-term engagement in a competitive market.

Social Media as a Key Platform

It goes without saying that social media is a critical component of any fintech marketing strategy. Second, it provides an opportunity to reach young, tech-savvy consumers. Social media channels such as LinkedIn, Twitter, and Instagram are great platforms for establishing brand awareness and connecting with potential customers.

An upstart fintech can use Instagram Stories to demonstrate its new app’s functionalities. It can use Twitter to tweet out short financial literacy messages. To connect successfully, share frequent and informative content that speaks to your audience.

Pull in your audience with interactive features such as polls or Q&A sessions to start lively conversations. Influencer marketing is the other major powerful tactic. Brands can expand their reach and establish credibility by partnering with other well-known, trusted voices in finance or tech.

Monitoring social media trends ensures that fintech companies remain relevant while adapting their messaging to audience expectations. Being regularly active and responsive on these channels can truly help to humanize the brand and create meaningful relationships with users.

Rising Role of Video Content in Marketing

Video content continues to grow in importance, engaging audiences faster and more efficiently while breaking down complex ideas into easily understandable concepts. Tutorials, explainer videos, or even customer testimonials can simplify fintech concepts like digital wallets or Buy Now, Pay Later (BNPL) services.

A simple video tutorial on how to set up a secure payment method can increase a user’s confidence significantly. This helps to demystify what is often a confusing and intimidating process. Including video in campaigns takes careful consideration.

Companies need to optimize videos for different platforms, making sure they load quickly and have the proper format for that specific platform. Interactive videos, like AR-powered visualizations of an investment portfolio, can help ensure that learning feels fresh and exciting.

Fintech brands that prioritize this educational but still visually stimulating content can better establish trust and demystify intimidating financial tools.

Focus on Data-Driven Campaigns

Data analytics is at the heart of fintech marketing, and through it, businesses can develop personalized messages that resonate with their target group. By analyzing customer behavior and identifying trends, preferences, and pain points, FinTech brands can create campaigns that feel relevant and impactful.

What’s as important as knowing who your audience is, though, is measuring campaign performance. Click-through rates, conversion rates, and user retention help you see what’s effective and what you should be changing.

Use these insights to maximize the ROI and financial viability of marketing programs. A data-first model will make transparency and data-driven decision-making a reality, and both will become even more critical with a tight regulatory environment.

Conclusion

Fintech marketing is revolutionizing how companies relate to their customers. It fuses technology with finance to develop smarter, more targeted, more intimate ways to connect. With the right strategies, fintech brands have the opportunity to cut through the noise, establish credibility, and scale at an accelerated pace. Being leaders requires that we get more precise with data analytics, concise with plain language content, and courageous with marketing campaigns.

The real key to success is paying attention to the needs of your customers. Effective fintech marketing takes the difficult concept and makes it simple, creating understanding and trust. Trends such as AI and personalization are already starting to pave the way to the future, creating even more opportunities to engage.

We know the fintech world is very fast-paced. It’s critical to keep a pulse on current events in your field and be flexible. Don’t wait; begin taking your marketing to the next level. Fintech marketing can become a gateway to new and exciting horizons with a proper strategy. So stay curious, stay bold, and keep surfing the innovation tide.