Generating leads is the main focus for fintech businesses, especially in these times of economic uncertainty brought about by the global market. Attracting top of funnel leads is a challenge for niche fintech, with specific channels like Google paid promotion proving to be especially inefficient. Read to see proven ways to attract ToF leads to your fintech.

Why top of the funnel leads are important for fintech

Top of the funnel (ToF) lead generation refers to the first stage of the buyer’s journey, when marketing efforts focus on spreading brand awareness and attracting leads that will convert to customers in the future. A constant pool of leads to the top of your marketing & sales funnel means you are keeping it full, with people always ready to be converted to the next stages.

In order to attract ToF leads, we recommend focusing on educational content. Usually people here look for ways to solve their problems, rather than for a specific solution. Creating valuable content that will educate people on how to approach their needs and then presenting that your solution is actually the best option for it will win you the relevant audience.

While content marketing is a powerful tool for fintech companies to become attractive to their potential clients and scale while building up a sustainable flow of leads, content distribution remains a challenge, as there are many channels you can use to promote your content. In our practice with innovative fintech companies, we employ three approaches to lead generation. Here is how you can use them as well!

Fintech lead generation marketing tactics

Fintech lead generation through LinkedIn

Google paid advertising has proved too costly for fintech, creating a need to look for more efficient channels. LinkedIn, a top paid and organic social channel for B2B businesses presents a major opportunity to grow both brand recognition and revenue. In fact, studies show that most LinkedIn users look specifically for professionally-geared content. If your potential audience is already looking for information to help grow their businesses, you should just meet them where they are!

LinkedIn is top channel for fintech lead generation because:

- It is a social network for business, therefore audience is keen to engage with a content/product/service that might be useful for their business

- It allows for the most detailed targeting regarding occupation, professional skills or professional interests than in any other social network

- It provides informative demographics reporting that helps to optimize targeting

- It has effective Lead Gen forms. They do not break the browsing experience, because they do not redirect to other sites. LinkedIn users are less inclined to switch from this social network to other websites during browsing and more inclined to receive content they are interested in here and now

So, LinkedIn should definitely be on your fintech marketing efforts radar. To make sure your fintech business really gets ToF leads from this social network, follow these strategies:

- Prepare for paid content distribution in LinkedIn by thoroughly researching your buyer persona. You need to have a portrait of a buyer persona not as an abstract user, but as several real profiles of those who might be your target audience. This is one more benefit of LinkedIn. You can easily find real people whose profiles fit your buyer persona image. Such profiles present a large amount of information that is helpful for targeting, like job titles, skills, company size, company industry, and member groups. Use them to set up your paid promotion.

- Your messaging should be clear: a user has to immediately understand what you offer, why it is useful for them, and what they should do with this info. All these three points should be both in text and image/video and the image should be easily readable.

- There are several “strategies” of building targeting in LinkedIn. You can use different parameters as base for your targeting, e.g. job seniority and function instead of job titles or member groups instead of interests, and so on. You should test all the variations to see which works best for you or for a certain lead magnet. Do not forget to regularly check demographics reports!

To see how your niche fintech business can profit from lead generation efforts in LinkedIn, let’s look at 42DM’s successful case:

We had just started working with a fintech client, whose product was an all-in-one payment platform. Their goal was to make digital banks and payment service providers trust their solutions and increase global awareness by attracting top of the funnel leads.

We performed target audience research and defined the TA as top-management of large enterprises in two industries: banks that provide acquiring solutions for businesses, and retail companies that use many payment systems and need one platform to simplify and secure thwir payment processes.

Then, we identified our target geos as Singapore, Australia, UK and New Zealand.

To reach these two target audiences, we decided to approach them through different case studies differentiated by what the client had delivered for each sector. The main focus in terms of messaging was the benefits of cooperation with our client, demonstrated by solid figures that were outlined in the case study. We also highlighted the client’s solution , explicitly showing how it solved the major pains and gains of the company in the relevant industry.

A variety of targeting parameter combinations were tested to reach the target audience: skills+seniority+function+company size+industry; titles+skills+company size+industry; member groups+seniority+company size+industry

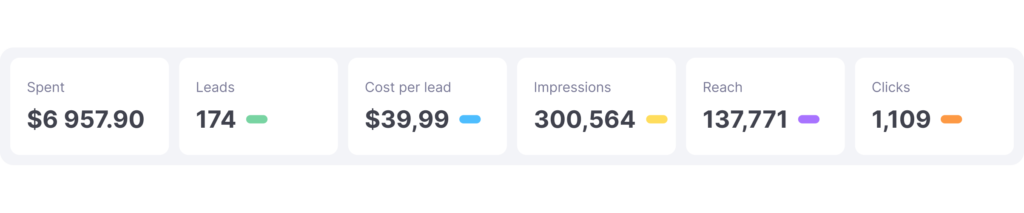

As a result, we attracted 174 top of the funnel leads in 4 months through LinkedIn with a cost per lead of $39.99.

So as you can see, LinkedIn has proven to be an effective channel for attracting leads to innovative fintech solutions. The best part is, you can easily use the above mentioned strategies to get similar results!

Fintech lead generation through cold emails, reply.io and HubSpot

Emails have always been a preferred channel for professional communication with the B2B fintech audience. However, as virtually everyone now tries to send their offers through emails, inboxes fill up quickly and it is difficult to cut through the noise. However, this doesn’t mean you should give up on cold emails as a lead generation channel — with some strategies and tools, you can achieve high open rates and hear back from your target audience.

At 42DM, we use cold emails for both our personal as well as our clients’ lead generation. Here are the steps that we always follow to get results:

- Research your buyer personas and choose one to create a cold outreach campaign for. That way you can go in depth to understand these people’s needs and wants, as well as form criteria on how to find them.

- Create a contact list of people who fit your buyer personas and are potentially interested in your product. We suggest using snov.io

- Create marketing materials that will target the needs of your target persona. For one campaign, you should have plenty of diverse materials that educate the audience on the solutions to their problems, give them value and showcase your company.

Here is a suggested asset mix:

1 lead magnet with market research on the topic in high demand

2 educational blog posts that dive deep into the TA’s pain(s) and present “how-to” solutions

2 case studies describing your successful projects

1 presentation about your fintech company

- Use your marketing materials to create an email thread you will send to the contacts. In each email, focus on the pain and gain your material presents, give numbers and insights, as well as links to the materials itself. We recommend a thread of short emails, starting with lead magnets and following the presentation of your fintech solution. Include CTAs at the end of each email!

- Set up an email thread with an email marketing tool. We use reply.io cause it allows users to set up the whole campaign at once, choosing the intervals between each email.

- Support your cold email campaign with social media posts. You now have lots of valuable content to share on your socials, but we also suggest adding valuable information on the topics you cover in the emails in case your prospects visit your pages to find out more about you.

- Analyze your campaign and reach out to prospects that show activity. We love HubSpot as an all-in-one analytics and CRM tool which can be easily connected to Reply.io and your marketing materials. We see HubSpot as a link for the campaign where all the data comes into one, allowing us to automate repetitive work and focus on what really matters. To increase the conversion rate of cold outreach campaigns, we look at webpage visits in HubSpot and customize the communication for specific people based on their activity.

Fintech lead generation through account-based marketing

When it comes to choosing a marketing strategy, Inbound Marketing is a great approach if you are targeting people who already want to speak to you. However, in the case of Fintech, it is challenging to get the attention of large retailers, banks or payment-related companies. Specifically, it is hard to identify and connect with key decision makers.

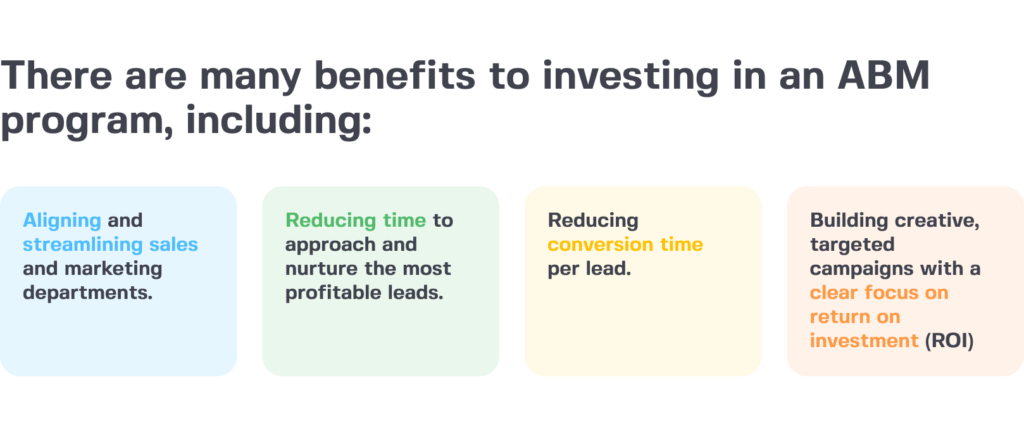

There is an advanced practice when it comes to attracting high-value leads – ABM. It is a way to connect both LinkedIn, reply.io and hubspot efforts we discussed above into one architecture and straighten it by advertising to the target accounts.

Account-based-marketing (ABM) is a strategy to align marketing and sales efforts to identify and appeal to your target customer. In other words, marketing budget is focused on the accounts that sales deems the most important.Together, sales and marketing gather insights and craft individual messages for each account to address their specific needs.

To successfully launch and use ABM for your fintech business, you would need to create a wide variety of hyper-relevant content for each target account and then use a technology to get this content seen. While content creation is creative work that a reliable agency partner can do for you, choosing the right software can be burdensome.

Here are two account-based advertising platforms we recommend looking into if you want to start ABM for your fintech company:

Metadata.io follows an account-based approach. This tool elimitanes the manual aspect of ABM, allowing you to focus on strategy and creativity. It matches your messaging with your B2B audience and provides automatic AI-driven campaign management opportunities across platforms, meaning your campaigns will be automatically optimized based on pipeline and revenues.

Influ2 is a people-based solution that helps you get your messaging in front of the specific people you want to target. For example, let’s say want to land Microsoft as your next client and have decided that the CFO is the person who makes decisions about hiring your fintech company. Tools like Influ2 can help you find and target the Microsoft CFO through multiple channels and optimize your campaign based on their reaction to the ads about your product.

Strategically approaching fintech lead generation in 2024

If you want to effectively generate top of the funnel leads for your fintech solution, using the above tactics will ensure your success. While focusing on best-performing channels is great, uniting your efforts and targeting the audience through omni-channel communication will help you really drive sales results during the approaching recession. That is why we recommend ABM.

However, to set-up and combine different tools, and create strategy and content flow, you will need a team of professionals working to maximize your success. This is where we are ready to help you create omni-channel lead-generation strategies, ensuring your growth!